Economics (McConnell), 18th EditionChapter 38: The Balance of Payments, Exchange Rates, and Trade DeficitsKey Questions1. Indicate whether each of the following creates a demand for or a supply of European euros in foreign exchange markets:

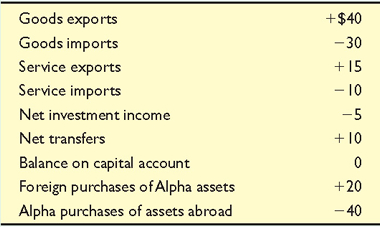

2. Alpha's balance of payments data for 2008 are shown below. All figures are in billions of dollars. What are the (a) balance on goods, (b) balance on goods and services, (c) balance on current account, and (d) balance on capital and financial account? Suppose Alpha needed to deposit $10 billion of official reserves into the capital and financial account to balance it against the current account. Does Alpha have a balance-of-payments deficit or surplus? Explain.  3. Explain why the U.S. demand for Mexican pesos is downward-sloping and the supply of pesos to Americans is upward-sloping. Assuming a system of flexible exchange rates between Mexico and the United States, indicate whether each of the following would cause the Mexican peso to appreciate or depreciate:

4. Diagram a market in which the equilibrium dollar price of 1 unit of fictitious currency zee (Z) is $5 (the exchange rate is $5 = Z1). Then show on your diagram a decline in the demand for Zee.

5. Suppose that a country follows a managed-float policy but that its exchange rate is currently floating freely. In addition, suppose that it currently has a massive current account deficit. Does it also have a balance of payments deficit? If it decides to engage in a currency manipulation in order to reduce the size of its current account deficit, will it buy or sell its own currency? As it does so, what will happen to its official reserves of foreign currencies? Will they get larger or smaller? And, finally, will the country have a balance of payments deficit while it is manipulating the exchange rate? |  |