Economics (McConnell), 18th EditionChapter 32:

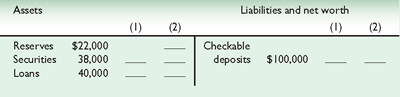

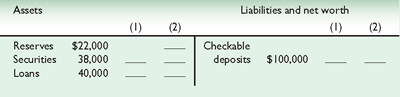

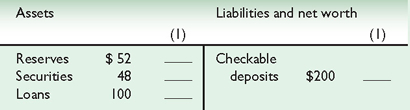

Money CreationKey Questions1. Why does the Federal Reserve require commercial banks to have reserves? Explain why reserves are an asset to commercial banks but a liability to the Federal Reserve Banks. What are excess reserves? How do you calculate the amount of excess reserves held by a bank? What is the significance of excess reserves? 2. "When a commercial bank makes loans, it creates money; when loans are repaid, money is destroyed." Explain. 3. Suppose that Continental Bank has the simplified balance sheet shown below and that the reserve ratio is 20 percent: - What is the maximum amount of new loans that this bank can make? Show in column 1 how the bank's balance sheet will appear after the bank has lent this additional amount.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/668740/KeyQuestion_Ch13_Graph01.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/668740/KeyQuestion_Ch13_Graph01.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a>- By how much has the supply of money changed? Explain.

- How will the bank's balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against the bank? Show the new balance sheet in column 2.

- Answer questions a, b, and c on the assumption that the reserve ratio is 15 percent.

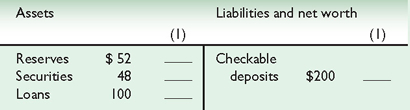

4. Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system. All figures are in billions. The reserve ratio is 25 percent.  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/668740/KeyQuestion_Ch13_Graph02.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (27.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/668740/KeyQuestion_Ch13_Graph02.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (27.0K)</a>- What amount of excess reserves does the commercial banking system have? What is the maximum amount the banking system might lend? Show in column 1 how the consolidated balance sheet would look after this amount has been lent. What is the monetary multiplier?

- Answer the questions in part a assuming the reserve ratio is 20 percent. Explain the resulting difference in the lending ability of the commercial banking system.

Chapter 32 Key Question Solutions

(44.0K) Chapter 32 Key Question Solutions

(44.0K)

|