Economics (McConnell), 18th EditionChapter 28:

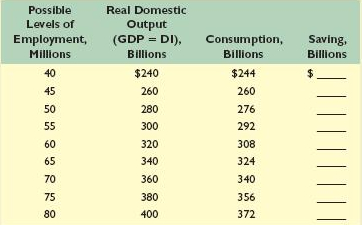

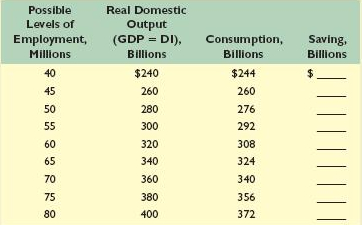

The Aggregate Expenditures ModelKey Questions1. Assuming the level of investment is $16 billion and independent of the level of total output, complete the accompanying table and determine the equilibrium levels of output and employment in this private closed economy. What are the sizes of the MPC and MPS?  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/627586/image3.jpg','popWin', 'width=419,height=305,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/627586/image3.jpg','popWin', 'width=419,height=305,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a>2. The data in columns 1 and 2 in the accompanying table are for a private closed economy: - Use columns 1 and 2 to determine the equilibrium GDP for this hypothetical economy.

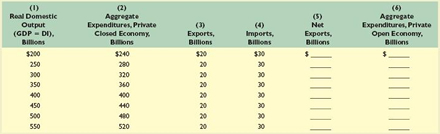

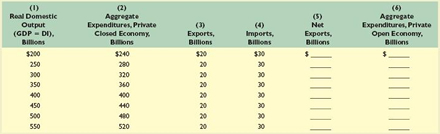

- Now open up this economy to international trade by including the export and import figures of columns 3 and 4. Fill in columns 5 and 6 and determine the equilibrium GDP for the open economy. Explain why this equilibrium GDP differs from that of the closed economy.

- Given the original $20 billion level of exports, what would be net exports and the equilibrium GDP if imports were $10 billion greater at each level of GDP?

- What is the multiplier in this example?

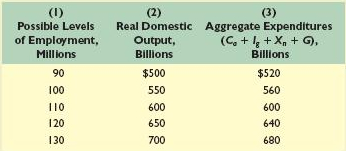

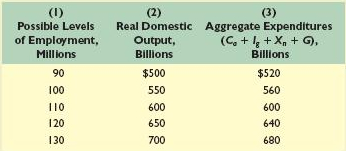

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/668736/KeyQuestion_Ch09_Graph02.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (35.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/668736/KeyQuestion_Ch09_Graph02.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (35.0K)</a>3. Refer to columns 1 and 6 in the table for question 9. Incorporate government into the table by assuming that it plans to tax and spend $20 billion at each possible level of GDP. Also assume that the tax is a personal tax and that government spending does not induce a shift in the private aggregate expenditures schedule. Compute and explain the change in equilibrium GDP caused by the addition of government. 4. Refer to the table below in answering the questions that follow: - If full employment in this economy is 130 million, will there be an inflationary expenditure gap or a recessionary expenditure gap? What will be the consequence of this gap? By how much would aggregate expenditures in column 3 have to change at each level of GDP to eliminate the inflationary expenditure gap or the recessionary expenditure gap? Explain. What is the multiplier in this example?

- Will there be an inflationary expenditure gap or a recessionary expenditure gap if the full-employment level of output is $500 billion? Explain the consequences. By how much would aggregate expenditures in column 3 have to change at each level of GDP to eliminate the gap? What is the multiplier in this example?

- Assuming that investment, net exports, and government expenditures do not change with changes in real GDP, what are the sizes of the MPC, the MPS, and the multiplier?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/627586/image2.jpg','popWin', 'width=403,height=228,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (34.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0025694212/627586/image2.jpg','popWin', 'width=403,height=228,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (34.0K)</a>

Chapter 28 Key Question Solutions

(61.0K) Chapter 28 Key Question Solutions

(61.0K)

|